Implementing social responsibility and low emissions goals in Australia will require more than just meeting the targets. How businesses weave sustainability into the very fabric of their risk frameworks will determine the outcome. This is where the consultants working in this area seem to miss the mark.

Engagement with stakeholders and heated workshops on emissions vary in effectiveness and serve their purpose. However, they leave the issue of sustainability risk overwhelm within an expanding enterprise. The resolution is in the risk management software, a crucial, yet underappreciated instrument within the sustainability consultant toolbox.

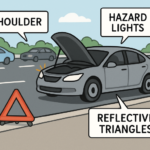

Over reliance on spreadsheets is underscored in the example on risk and sustainability.

Almost every single consultant nowadays will scoop up the data, drawing a distinction between sustainability and managing the rest of the components of the business. Setting boundaries in which the goals will be pursued, putting structures in which advice is collated, and followed, and reporting success is easy. But risk? This is where a consultant’s worth is put to the test. What system will incorporate their gatherings with the same systems used to manage financial, operational, and safety threats?

Barely any mid- to large- sized organizations in Australia still leave risk as an un centralised system. Participants in these organizations cite systems like Skytrust, entity- integrated ERP systems, and, Protecht as centralised risk management platforms. Social and environmental risks however still remain lodged in sophisticated systems. Untracked registers and un told ESG reports.

What’s more perplexing: you’ll spend a million bucks to manage climate transition risks on a PowerPoint presentation, yet a $50,000 delay by a supplier gets logged into some enterprise-risk software? This disconnect reduces accountability, blindsides executives, and undermines reporting accuracy. There is a need for sustainability consultants to begin retraining and viewing their advisory role as integrative risk managers.

The Use of Registers for Sustainability-Linked Risks

Software made for managing risk today is no longer restricted to only supply chain disruptions and safety audits. Most platforms that are used in Australia today come bundled with proprietary risk categories, multidimensional score action tracking, compliance obligations, and risk association.

Their climate risk profile is aligned to operational locations.

Their procurement practices associate modern slavery risks and debts.

Their infrastructure expansion plans flag the dependencies of water and biodiversity.

Their social license risks are coupled with stakeholder mapping tools.

Sustainability consultants that appreciate the modern risk management software’s capabilities are in a position to eliminate the “after-the-fact” reporting which many consultants are currently focused on. Instead, these risks should be embedded into the governance framework of the client, ensuring that there is a clear connection between actual risks and mitigation. This is done by governance framework to mitigation tasks connected at the board level with operational visibility.

Closing the Gap Between Legal Compliance and Sustainability

A compliance register is another area that many consultants providing ESG services in Australia tend to ignore. There are walking offences of the EPA, Modern Slavery Act, WHS Codes, and very soon, Climate-Related Financial Disclosures. All these laws carry legal obligations.

The software and tools used by a business may store ESG obligations in different locations. In such a case, a business would not fully understand its ESG risks. Using risk management software would allow a business to apply its compliance obligations in real time to understood ESG risks. This, in turn, would allow a business to assess and verify obligations in real time.

Sustainability consultants who work with the lawyers and risk management teams to embed ESG obligations into compliance registers (using the same software) deliver greater value than those who work on a stand-alone ESG gap analysis.

Dynamic Risk Assessment for a Volatile ESG Landscape

The current state of ESG compliance requirements and expectations in Australia are changing rapidly. Everything from the development of the Taskforce on Nature-Related Financial Disclosures (TNFD) to the Australian Securities and Investments Commission (ASIC) scrutiny over instances of greenwashing; an ESG risk that is considered to be low today could, with no warning, create an insurmountable problem.

These changes create an opportunity for business consultants. Risk management tools enable them to move from an obsolete, static analysis of the risk profile of a client to a dynamic model of the risk. Consultants have access to a wide range of software that has the following features.

Real-time dashboards that flag overdue actions with automated alerts

Customized reporting segmented by department, site, or zone of influence

Integration with audit and assurance systems

These features enable consultants to assist their clients in proactively monitoring evolving ESG risk profiles, adjusting their risk control frameworks, and ensuring legal compliance in a world of evolving regulations.

Zone In On Executive Buy-In and Align Systems to Solve It

One of the greatest barriers to achieving sustainability in Australia has to do with the engagement of executives. Boards and CFOs do overrides much more easily with the risks manifesting on the enterprise dashboard than on a consultant’s isolated ESG report.

Through the client’s risk management system, sustainability consultants acquire access to direct internal controls, audit logs, and performance metrics. This increases trust and credibility and assures with certainty that sustainability features in enterprise governance systems—not peripheral tasks to the environment team.

Put It This Way—The Software Is Already Available—Just Use It

The Australian business community has enough tools. What they need is proper consolidation of those tools. The majority of Australian businesses possess risk management software. It is one of the most robust, flexible, and underused tools for ESG purposes.

Consultants trained to the available ESG risk management software that are designed for compliance tasks with board-level triggers will provide better value than those that continue the reliance on spreadsheets.

Sustainability is not only a matter of strategy— it is a matter of operations, and the risk management software available is the operating system for that strategy.