For any organization, ensuring smooth and efficient financial operations is key to business success. Two critical processes that directly influence operational efficiency and financial control are Requisition Approval Workflow and Automating Project Budget Allocations. By streamlining these processes, CFOs can not only reduce the risk of errors and delays but also ensure better decision-making and transparency. In this blog, we’ll explore how automating Requisition Approval Workflow and how to automate project budget allocations can save time, reduce costs, and enhance organizational efficiency.

Understanding the Requisition Approval Workflow

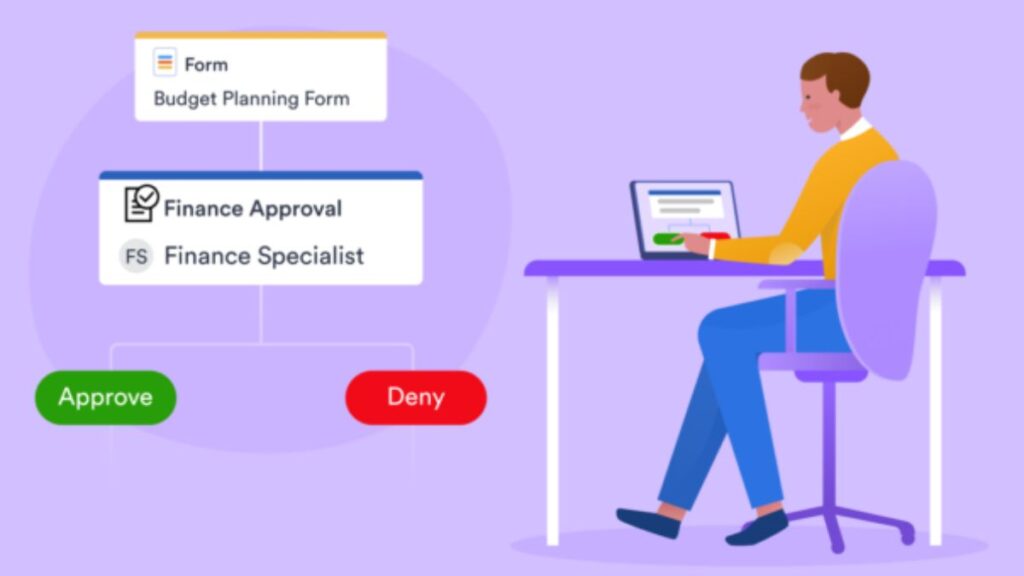

The requisition approval workflow is a fundamental process in any organization, particularly when it comes to managing expenses and resources. A requisition is essentially a formal request for goods or services within an organization, and the approval workflow is the series of steps through which these requests must pass before being authorized.

Typically, requisition workflows involve multiple layers of approvals — from the department requesting the item, to the procurement team, and sometimes to the finance team for final approval. However, as businesses grow, these workflows become more complex, leading to bottlenecks, delays, and potential errors.

Automating the requisition approval process is a game-changer for CFOs. With automation, all requisitions can be tracked in real-time, approval stages are streamlined, and reminders are sent for approvals, ensuring that nothing gets overlooked. Not only does this reduce administrative burden, but it also improves visibility into the purchasing process, which is crucial for keeping budgets under control.

The Importance of Automating Project Budget Allocations

Just like requisition approvals, managing project budget allocations is a crucial responsibility for CFOs. With multiple projects running simultaneously, tracking and allocating budgets manually can become an overwhelming task. An automated system, on the other hand, ensures that each project receives its proper share of funding, reducing the risk of overspending and ensuring compliance with financial policies.

How to automate project budget allocations effectively lies in the use of technology that integrates all financial processes within one centralized platform. Through automation, CFOs can create predefined budget templates, set up alerts for budget limits, and even automatically assign funds based on project requirements. This eliminates the need for back-and-forth communication and manual checks, providing greater accuracy and less chance for human error.

An automated system for budget allocation also enhances collaboration between teams. Since the platform will have up-to-date information on the status of each project and its allocated budget, it helps teams make informed decisions quickly, ensuring that projects stay on track and within budget.

By automating these workflows, organizations are not just improving their internal processes, but they are also enhancing their ability to manage financial risks. With a more efficient budget allocation process, CFOs can make data-driven decisions and ensure that their projects stay on budget, leading to better financial outcomes for the organization as a whole.

Benefits of Automating Requisition Approval Workflow and Project Budget Allocations

- Increased Efficiency: Automating both requisition approval and budget allocation workflows reduces manual effort and ensures a faster, more streamlined process. This is especially important for CFOs looking to minimize delays and accelerate decision-making.

- Cost Control: With automation, businesses can better track expenses, prevent budget overruns, and optimize resource allocation. CFOs can identify potential savings and avoid unnecessary costs, leading to a healthier bottom line.

- Transparency and Compliance: Automated workflows provide a transparent view of all approval stages, budgets, and spending, ensuring that businesses remain compliant with internal policies and industry regulations. This helps CFOs track spending in real-time, ensuring no overspending occurs.

- Error Reduction: Human error is inevitable in manual processes. However, automation minimizes this risk, ensuring that approvals and budget allocations are accurate, consistent, and free of costly mistakes.

- Improved Collaboration: When both requisition approval and budget allocations are automated, it fosters better communication between departments, teams, and stakeholders. All relevant parties have access to the same data, promoting collaboration and reducing misunderstandings.

Key Features to Look for in Automation Tools

When selecting a solution to automate these processes, CFOs should consider the following features:

- Customizable Approval Workflow: Look for a tool that allows you to set up workflows that align with your company’s unique processes.

- Real-time Tracking: The ability to track requisitions and budget allocations in real-time ensures that no request or project goes unnoticed.

- Alerts and Notifications: Automated reminders for pending approvals or budget limits will keep the process moving smoothly.

- Integration Capabilities: The tool should integrate seamlessly with other financial systems, such as accounting software or ERP systems, to ensure data consistency across platforms.

Conclusion:

As CFOs continue to navigate the complex landscape of financial management, automation presents an opportunity to streamline crucial processes such as Requisition Approval Workflow and Automating Project Budget Allocations. By adopting automated solutions, businesses can not only improve operational efficiency but also ensure greater accuracy, compliance, and cost control. Embracing these technologies will help CFOs lead their organizations towards more informed, data-driven decision-making and a stronger financial future.