Banks manage complex procurement and payment activities every day. From selecting vendors to making final payments, each step must be accurate, transparent, and compliant with regulations. A well-defined source-to-pay process helps banks control spending and reduce risks. When this process is optimized using BPM in the banking industry, banks can automate workflows, improve efficiency, and maintain strong governance across financial operations.

Understanding the Source to Pay Process in Banking

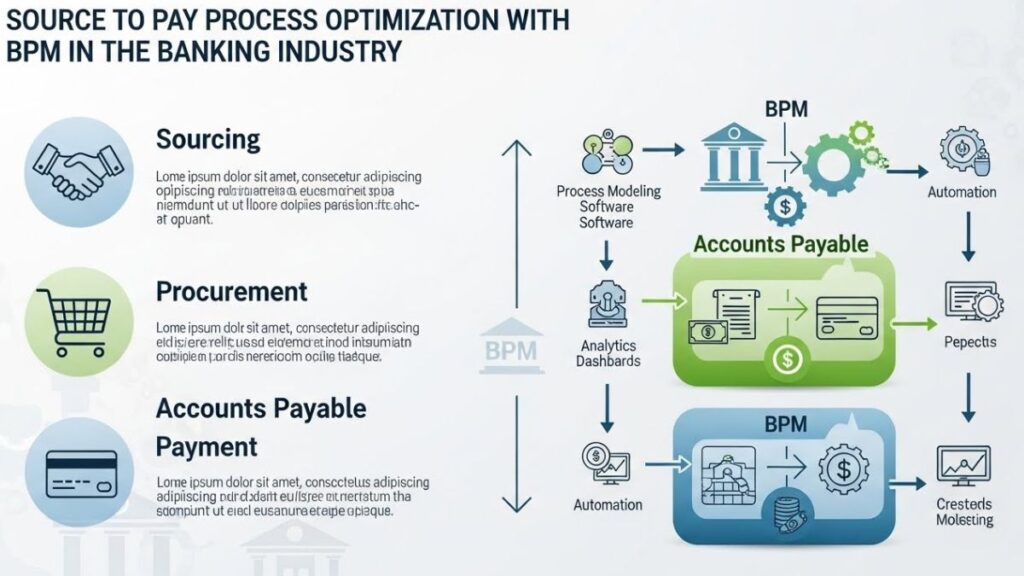

The source-to-pay process covers the entire procurement lifecycle. It starts with sourcing vendors, negotiating contracts, raising purchase requests, approving orders, receiving goods or services, and finally processing payments.

In banks, this process involves multiple departments and strict regulatory requirements. Manual handling can cause delays, errors, and compliance risks. A structured source to pay process ensures consistency and accountability at every stage.

Challenges in Traditional Banking Procurement

Banks often rely on legacy systems and manual workflows. These systems may not communicate well with each other, leading to data silos and limited visibility.

Approval delays, lack of spend transparency, and poor vendor management are common issues. These challenges can increase operational costs and expose banks to financial and compliance risks.

Role of BPM in the Banking Industry

Business Process Management (BPM) helps banks design, automate, and monitor workflows. BPM tools provide a structured framework to manage complex processes with clear rules and controls.

In the banking industry, BPM plays a critical role in improving efficiency, ensuring compliance, and reducing operational risk. It allows banks to standardize processes while maintaining flexibility.

Optimizing Source to Pay with BPM

When BPM is applied to the source-to-pay process, banks can automate procurement workflows end-to-end. BPM tools define approval hierarchies, enforce policies, and route tasks automatically.

This reduces manual intervention and ensures that every transaction follows predefined rules. As a result, banks gain better control over procurement and payments.

Improved Spend Visibility and Control

One of the biggest benefits of BPM-driven source-to-pay optimization is real-time visibility. Banks can track spending across departments and vendors through centralized dashboards.

This visibility helps finance teams monitor budgets, prevent overspending, and make informed financial decisions.

Faster and More Reliable Approvals

BPM automates approval workflows, ensuring that purchase requests and invoices reach the right approvers without delay.

Approvers receive notifications and can review requests from anywhere. This speeds up decision-making while maintaining strict control over approvals.

Enhanced Compliance and Risk Management

Compliance is critical in the banking industry. BPM ensures that procurement and payment processes follow regulatory and internal policies.

Every action is logged, creating a detailed audit trail. This makes audits easier and reduces the risk of non-compliance or fraud.

Better Vendor Management

Optimized source to pay processes improve vendor onboarding, contract management, and payment accuracy.

Timely payments and clear communication strengthen vendor relationships and help banks negotiate better terms.

Reduced Operational Costs

Automation reduces manual work and minimizes errors. This leads to lower processing costs and improved efficiency.

By streamlining workflows, banks can reallocate resources to more strategic activities.

Scalability for Growing Banking Operations

As banks expand, procurement volumes increase. BPM-based source to pay solutions scale easily to handle higher transaction volumes without affecting performance.

New workflows can be added quickly, supporting business growth and digital transformation.

Supporting Digital Transformation in Banking

Source-to-pay optimization with BPM supports banks’ digital transformation goals. It replaces manual processes with intelligent automation and data-driven decision-making.

This improves agility and helps banks adapt to changing market and regulatory demands.

Conclusion

Optimizing the source-to-pay process is essential for banks to maintain financial control, efficiency, and compliance. By using BPM in the banking industry, banks can automate procurement and payment workflows, improve visibility, and reduce risks.

Source-to-pay process optimization enables banks to streamline operations, control spending, and support digital transformation. For banks looking to modernize procurement and strengthen governance, BPM-driven source-to-pay solutions offer a reliable and scalable approach.