In the fast-moving world of cryptocurrency, blockchain ecosystems like Avalanche (AVAX) have become major hubs for decentralized finance (DeFi), NFTs, and smart-contract-based investments. Avalanche’s high speed, scalability, and low fees make it an attractive network for developers and traders alike.

Amid this growing ecosystem, platforms such as Crypto30x.com Avalanche have emerged — claiming to provide users with trading, staking, or investment opportunities linked to Avalanche and other blockchain projects. However, before engaging with any site promising fast or guaranteed returns, it’s critical to evaluate how it works, whether it is legitimate, and what risks may be involved.

This article explores what Crypto30x.com Avalanche claims to offer, how it connects (or claims to connect) with Avalanche, and how to stay safe while investing in blockchain-based opportunities.

What Is Crypto30x.com?

Crypto30x.com appears to be a cryptocurrency investment or trading website that promotes opportunities to earn profits — often mentioning “x30” growth potential, automated trading systems, or blockchain partnerships such as Avalanche (AVAX).

The platform’s content may vary, but generally includes features like:

-

Investment plans offering fixed or compounding returns

-

Claims of integration with major blockchains or crypto exchanges

-

Automated trading tools using AI or algorithms

-

Referral or affiliate programs

These features are commonly found among high-yield investment programs (HYIPs) or speculative DeFi sites that promise exponential returns. It’s essential to separate marketing claims from verified blockchain activity.

Understanding Avalanche (AVAX)

Before evaluating Crypto30x.com’s claims, let’s clarify what Avalanche actually is.

1. Avalanche Overview

Avalanche is a layer-1 blockchain platform developed by Ava Labs. It was designed to overcome some of the limitations seen in earlier networks like Ethereum and Bitcoin — particularly scalability, transaction speed, and fees.

2. Key Features of Avalanche

-

High Throughput: Can process over 4,500 transactions per second (TPS).

-

Low Latency: Transaction finality in under two seconds.

-

Subnets: Developers can create custom, interoperable blockchains within Avalanche’s ecosystem.

-

EVM Compatibility: Supports Ethereum-based smart contracts, making migration simple.

-

Proof-of-Stake (PoS) Mechanism: Environmentally friendly and energy-efficient consensus.

3. Use Cases

Avalanche powers:

-

DeFi platforms (like Aave, Trader Joe, and Benqi)

-

NFT marketplaces

-

Token launches and staking systems

-

Gaming and metaverse projects

Because of its speed and reliability, Avalanche has become one of the top five blockchains for decentralized applications (dApps).

Does Crypto30x.com Really Operate on Avalanche?

Crypto30x.com’s marketing sometimes associates its brand with Avalanche (AVAX) — implying that its services, tokens, or investment pools are powered by Avalanche smart contracts.

However, as of now, there is no verified record of a Crypto30x smart contract or DeFi protocol deployed on Avalanche’s official network.

Avalanche maintains a transparent public blockchain, and legitimate projects can be verified via:

-

Snowtrace.io (Avalanche’s block explorer)

-

Avalanche’s dApp directories

-

Public DeFi analytics platforms (like DeFiLlama)

If Crypto30x.com Avalanche were truly part of Avalanche’s ecosystem, it would have:

-

A verifiable smart contract address

-

Liquidity pools visible on Trader Joe or Pangolin

-

Transparent staking or farming data

Since these do not appear to exist publicly, it is wise to treat any claims of Avalanche integration as marketing statements rather than confirmed technical facts.

How Crypto30x.com Avalanche Claims to Work

Although the website’s exact layout may change, platforms like Crypto30x.com Avalanche usually follow a similar structure:

-

Sign-Up:

Users create an account with their email or crypto wallet address. -

Deposit Stage:

The platform asks users to deposit cryptocurrency — often in AVAX, Bitcoin, USDT, or Ethereum — as initial investment capital. -

Investment Plans:

Users are invited to select a plan (e.g., 5% daily profit, 200% monthly ROI, or “30× potential”). -

Automated Trading or Staking:

The website claims to use “AI bots” or “DeFi protocols” to generate profits. -

Withdrawals:

Users can allegedly withdraw funds at any time, though many similar sites eventually delay or block payouts.

While some new platforms experiment with yield farming or DeFi integration, guaranteed or fixed returns are always a major red flag in crypto.

Is Crypto30x.com Legitimate or a Potential Scam?

At present, there is no independent verification that Crypto30x.com is a registered financial entity or an officially recognized Avalanche project.

1. No Regulatory Licensing

The site does not appear in databases of:

-

The U.S. Securities and Exchange Commission (SEC)

-

The UK Financial Conduct Authority (FCA)

-

The Australian Securities and Investments Commission (ASIC)

-

The European ESMA or CySEC registers

This means Crypto30x.com operates without legal oversight.

2. Unrealistic Profit Claims

Promises like “30× return potential” or “guaranteed daily profit” are inconsistent with real crypto-market volatility. Legitimate DeFi protocols cannot promise such fixed gains.

3. Anonymous Ownership

No verified information exists about the company’s founders, developers, or operational address.

4. No On-Chain Verification

No trace of Crypto30x smart contracts, liquidity pools, or audited code on Avalanche.

5. Short-Lived Domains

Sites like Crypto30x.com Avalanche often have recently registered domains and may disappear or change names after a few months — a common HYIP pattern.

Verdict:

While the name “Avalanche” gives the platform technological credibility, current evidence suggests that Crypto30x.com operates independently of Avalanche’s verified ecosystem and should be approached with extreme caution.

Risks of Using Unregulated Crypto Platforms

1. Loss of Funds

Without regulatory oversight or public audits, deposited funds may not be recoverable if the site shuts down.

2. Phishing and Data Theft

Some platforms collect personal data or wallet addresses for malicious purposes.

3. Lack of Transparency

No verifiable smart contract = no proof that your deposits are being traded, staked, or invested as claimed.

4. Pump-and-Dump Tokens

Some projects issue their own “tokens” without liquidity, making it impossible to sell them later.

5. Regulatory Crackdowns

Governments increasingly target unlicensed crypto investment sites, freezing their funds and blocking access.

How to Verify Avalanche Projects Safely

If you’re interested in Avalanche-based investments, always verify authenticity through:

-

Avalanche’s Official Website – avax.network

-

Snowtrace.io – The official Avalanche blockchain explorer.

-

Coingecko / CoinMarketCap – Lists verified tokens and DeFi protocols.

-

DeFiLlama – Tracks legitimate Avalanche protocols by total value locked (TVL).

-

Community Channels – Check Reddit, Twitter, or Avalanche’s Discord for discussions about new projects.

If Crypto30x.com (or any similar platform) isn’t listed on these trusted sources, it likely operates outside Avalanche’s legitimate ecosystem.

Legitimate Avalanche Investment Options

Instead of using unverified sites like Crypto30x.com, consider legitimate, audited Avalanche DeFi protocols such as:

1. Trader Joe

Avalanche’s most popular decentralized exchange (DEX), offering trading, staking, and liquidity farming.

2. Benqi

A DeFi lending and staking protocol built natively on Avalanche.

3. Aave

One of the largest DeFi platforms, which now supports the Avalanche network.

4. Yield Yak

A yield optimizer that automates staking rewards safely on Avalanche.

5. Pangolin

Another well-established DEX known for reliable swaps and cross-chain liquidity.

These platforms are open-source, verifiable, and backed by on-chain data — meaning you can confirm transactions and performance transparently.

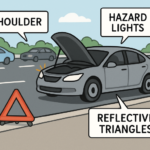

How to Protect Yourself When Exploring New Crypto Platforms

-

Check the Domain Age: Use WHOIS to see when the website was created.

-

Search for Smart Contracts: Verify any “staking” or “investment” addresses on Snowtrace.io.

-

Avoid Unrealistic Promises: Legitimate DeFi yields fluctuate; fixed high returns are usually false.

-

Start Small: If testing a new platform, use only what you can afford to lose.

-

Use a Separate Wallet: Never connect your primary wallet to unverified dApps.

-

Look for Independent Reviews: Rely on trusted crypto forums and watchdog websites.

Conclusion

Avalanche (AVAX) is one of the most advanced and trusted blockchain platforms in the DeFi ecosystem. However, Crypto30x.com — despite referencing Avalanche — currently lacks transparency, regulation, or verifiable blockchain integration.

While Avalanche itself offers many legitimate investment and staking opportunities, users should remain skeptical of third-party sites promising guaranteed or 30× returns. Such claims often indicate high-risk or fraudulent operations.

Always verify any crypto investment with official sources, on-chain explorers, and the project’s community channels. In cryptocurrency, knowledge and caution are your best defenses against loss.